1M+ People Trust Kikoff To Help Them Build Credit – Here’s What We Think!

I’ve always been a bit skeptical when it comes to financial tools that claim to build your credit quickly. I mean, we’ve all seen the ads, right? The ones that promise to skyrocket your credit overnight and have you living your best life in no time. But, like many of you, I’ve struggled with building credit. It’s frustrating, confusing, and, honestly, a bit terrifying.

That’s why when I started seeing Kikoff pop up everywhere—on Instagram and TikTok— I wasn’t sure what to think. There was a lot of hype, but would it live up to expectations? I decided to try it out for myself and here’s what I found:

1. It’s super easy to get started—and without a credit check

One of the first things that caught my attention was how easy it was to sign up for Kikoff. There were no invasive credit checks or complicated paperwork—just a simple sign-up process that took me five minutes from start to finish. All I had to do was enter some basic personal information and I was in.

Best of all, since Kikoff doesn’t require a hard credit pull. For someone who’s been burned by credit checks in the past, this was a huge relief.

2. Yes, you’ll see real, tangible results

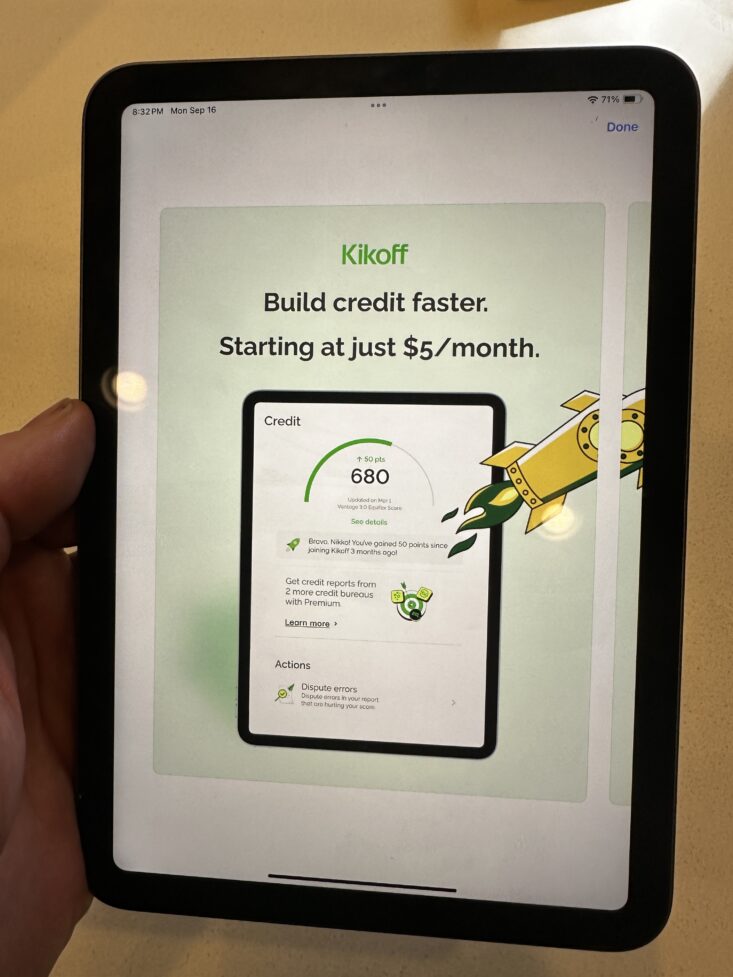

In just my first month, I saw my credit jump by 30 points. It’s not a magic bullet, but it’s more than I could do alone. According to Kikoff, new users under 600 see an average increase of 28 points in their first month and 58 points in their first year. I’ll take it!

One thing I really liked is that Kikoff reports to all three major credit bureaus—Experian, Equifax, and TransUnion—so your progress shows up everywhere. A lot of other services only report to one or two, so with Kikoff, you’re covered across the board.

3. It’s quite affordable for what you get

I’m not going to lie, I wasn’t really looking to drop hundreds of dollars a month on credit-building tools. That’s why the pricing for Kikoff impressed me. The Basic Plan is only $5 a month. That’s like skipping one latte a month to improve your credit.

The Premium Plan offers even more perks at $20 a month, like a bigger tradeline (a fancy term for an account that shows up on your credit report) and rent reporting. This meant I could focus on improving my credit without the temptation to rack up debt.

4. I’m not just building my credit; I’m learning how to keep it up

One of the things I love most about Kikoff is that it’s not just a set-it-and-forget-it kind of tool. It’s an educational platform designed to help you understand how credit works and how to use it to your advantage. The free credit monitoring is just the cherry on top.

5. It’s trusted by people who’ve been where you (and I) have been before

At the end of the day, what convinced me to stick with Kikoff was hearing from real people who’ve used it successfully. I read countless stories from folks in the same boat as me: frustrated, anxious, and unsure where to turn.

I kept reading the positive reviews ⭐⭐⭐⭐⭐, and knowing that this isn’t just a “one-size-fits-all” solution but something adaptable to individual needs and situations really sealed the deal for me.

So…Is Kikoff worth it? Absolutely

The truth is that whether you’re trying to build credit for the first time or bounce back from a financial setback, Kikoff offers a simple, affordable, and effective solution. With over a million people on board and nearly 98% giving it five stars, it’s clear that a lot of people—myself included—have found real value in it.