How To Build Your Credit in 4 Easy Steps

Building credit can feel like an uphill battle, especially when you’re starting from scratch. Whether you’re fresh out of school, trying to recover from some tough financial decisions, or moving to the USA with no credit history, it’s easy to feel overwhelmed. But the good news is that there are straightforward ways to work on your credit without adding extra stress.

When I first started looking into building credit, I was determined to turn things around. I needed a practical solution that worked—and fast. After doing some research, I found Kikoff, a credit-building hack that helped me go from having almost no credit to being able to qualify for loans and more in just a few months. Let me walk you through how it works.

Step #1: Try Kikoff

When I searched around online, I came across Kikoff and was surprised I’d never heard of them considering they’re the #1 credit building app on the App Store with 4.9 stars and over 110k+ reviews!

With Kikoff, you can open a line of credit exclusively for credit building and report to all three credit bureaus – Equifax, Experian and TransUnion. They offer a quick and easy way to build credit for the ultimate newbie like myself.

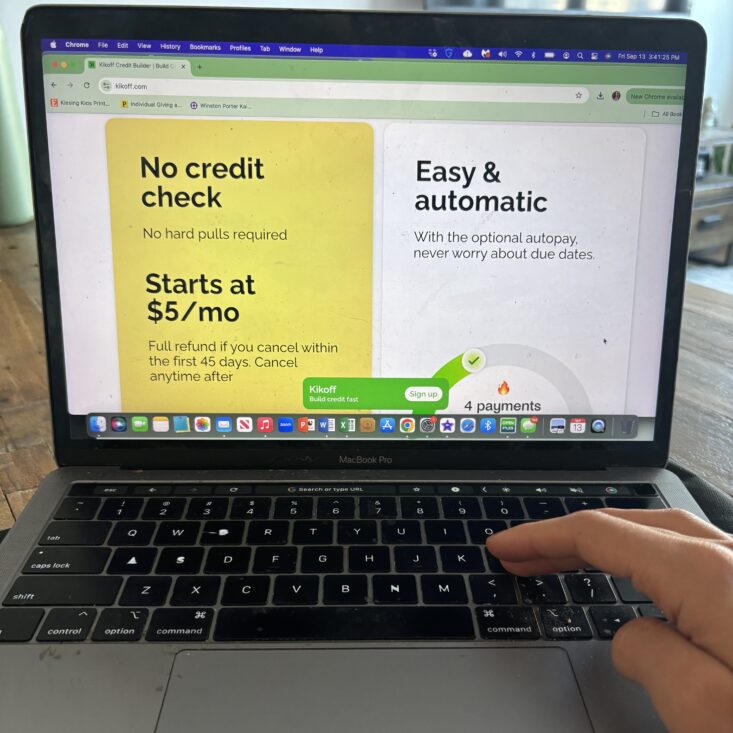

There are several plans to choose from based on your personal budget and needs. No credit? No problem. Low credit? No problem! Seemed too good to be true, but I was DESPERATE to build credit so I was willing to try ANYTHING….

Step #2: That’s it – just start with Kikoff

Once you sign up for Kikoff, you’re on your way. There’s no complex process to follow—just one simple step.

Here’s why:

Set up in minutes with no credit check

It was quick and easy to set up my account with Kikoff – no credit check necessary. I was debating between the Basic or Premium plan, and decided to try Basic first to test the waters. They provided me with a credit line of $750 which I only used to make the monthly payments for my plan, which I just paid off on autopay every month.

Though this money can’t be used for personal purchases, having a $750 line of credit is an amazing way to start establishing credit. Every time I paid for the plan, it was considered “good behavior” and was reported to the credit bureaus, further raising my credit. Total hassle-free!

Start to build your credit in as little as one month

Within the first month, I noticed a jump in my credit. And this short-term bump was followed by steady increases in the months that followed. I now understand why Kikoff has been highlighted by big names like Credit Karma, Nerd Wallet, CNBC, PennyHoarder, Wired, and more as a smart, hassle-free way to build credit fast—no credit checks, scammy repair schemes, or worries about piling up high-interest debt.

Multiple plans to choose from

After a couple of months, I was amazed at how well it was working and decided to upgrade to Premium. Basic runs at $5/month on a $750 line of credit, while Premium is $20/month and can unlock a $2500 line. On top of the features of Basic, Premium also comes with rent reporting. This basically means that every time you pay rent on time you’re building credit – and man, I saw my credit bump up even further with this upgrade!

From Credit-Building to Life-Changing

After just a few months, I was able to qualify for loans that would have been out of reach before. I was absolutely elated, and SO glad that I gave Kikoff a chance! It’s a MUST for anyone needing a work on to their credit. It can change your life just like it changed mine.