In This Economy?! Here’s My #1 Hack For Taking Back Financial Control During Uncertain Times

We all know times are tough. Between inflation and an uncertain economy, it can feel overwhelming to stay on top of everything—especially your credit. But as an ex-finance professional turned credit coach, I’ll let you in on my #1 hack: Kikoff.

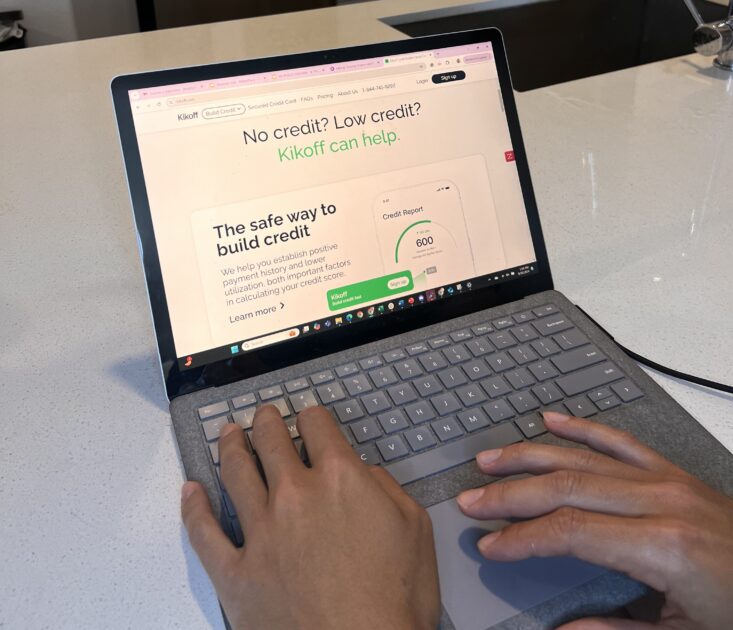

Whether you’re just starting out or rebuilding after financial setbacks, good credit is essential. It can unlock everything from lower interest rates on loans to better rental options and even job opportunities. If your credit history is lacking or in bad shape, Kikoff makes building credit easier than ever. Here’s how:

1. Credit Building on Autopilot

When life feels chaotic, who has time to figure out how to improve their credit? Kikoff makes it simple., Kikoff gives you a $750 tradeline—a revolving credit account designed to report your responsible payments to the credit bureaus.

For $5 a month, it helps optimize key credit factors to all three bureaus.

Think of it as your credit-building sidekick, consistently reporting healthy credit habits on Autopay every month. There are no credit checks, no complex processes, and most importantly, no hassle. This is the perfect option for anyone looking to build credit without a ton of effort, especially young adults or those who have recently moved to the U.S.

2. Rent Reporting – A Hidden Gem

If you’re already paying rent every month, why not get credit for it? With Kikoff Premium ($20/month), your rent payments can be reported to credit bureaus, giving your credit a significant leg up.

Rent reporting, which allows rent payments to show up on your credit report (normally they don’t), is especially useful for anyone who doesn’t have many traditional credit accounts, like credit cards or loans. You’re already paying rent, so why not make those payments count?

3. Peace of Mind With 3-Bureau Credit Monitoring

In today’s uncertain economy, financial security is top of mind. Kikoff provides free credit monitoring with both plans, helping you keep tabs on your credit activity and stay aware of any suspicious behavior. Credit monitoring alerts you to any changes such as new accounts or inquiries, so you can act quickly if something seems off.

Premium users also receive 3-bureau credit reports, offering a full summary of their credit history from all major bureaus. While monitoring keeps you updated on new activity, credit reports provide a detailed snapshot of your entire credit profile, showing things like your payment history, balances, and open accounts. These insights help you stay proactive, and you can sleep easier knowing Kikoff has your back.

4. Affordable, No-Frills Pricing

Let’s talk about affordability—because improving your credit shouldn’t come with a hefty price tag. Kikoff Basic is just $5 a month. That’s less than a cup of coffee! For such a low monthly cost, you’re getting a simple, effective credit-building tool that reports to all three credit bureaus.

If you want to take it a step further, Kikoff Premium offers even more at $20 a month. You can get access to a specialized $2,500 credit line—designed to help bump up your credit faster by lowering your credit utilization ratio (the percentage of your available credit that you’re using), plus the added benefits of rent reporting and access to credit reports.

5. No Credit Check & Fast Setup

We know how nerve-wracking a credit check can be, especially if your credit isn’t where you want it to be. But with Kikoff, there’s no credit check required to get started.

You can sign up in minutes and begin building credit right away. It’s one of the easiest ways to start your credit-building journey, especially if you’re starting from scratch or need to rebuild after some financial setbacks.

Kikoff Sets You Up For Your Future

In a world where financial stability feels like it’s constantly slipping through our fingers, Kikoff is the tool you need to keep your peace of mind. Whether you’re choosing the affordable Basic plan or the feature-packed Premium plan, Kikoff helps you take control of your credit journey.

For less than the cost of a night out, you can invest in something that pays off in the long run—your financial health.