Tackling my Finances Felt Impossible – Until I Found Fruitful

Disclosure: This testimonial may not be representative of the experience of other clients. Testimonials are no guarantee of future performance or success. The author was not paid for her testimonial but received a non-monetary benefit in the form of a three-month Fruitful membership to try our services. Additionally, Fruitful compensated a third-party campaign to write the article. Please view additional disclosures at the end of this article.

My husband and I have always dreamed of having a big family, but with each adorable addition comes a growing list of financial responsibilities. From college funds to bigger living spaces, the numbers for baby #2 and beyond just didn’t add up.

Like many, I found myself lost in a sea of budget spreadsheets and investment apps, unsure where to even start or how much to save—and with no one to talk to for real guidance. Then I started working with Fruitful, and it completely changed how I approached our finances. Suddenly, what once seemed impossible became not only manageable but downright easy.

Understanding My Financial Picture with Empathy

Before Fruitful, the idea of financial planning felt overwhelming. Thinking about saving for a bigger house, planning for retirement, or even budgeting for the next month seemed like puzzles I couldn’t solve. While talking about money is one thing, feeling heard and having an actual financial plan is another.

Thankfully, Fruitful connected me with a guide who didn’t just see numbers—she saw our future. She took the time to really understand our situation, making me feel seen and heard in a way I hadn’t experienced before. It felt like having a financial therapist—someone who listened, understood, and gently nudged me away from bad habits.

A Personalized Plan for a Growing Family

When my husband and I started planning for baby number two, I was flooded with questions. How much will diapers cost again? What about college? How much should we save? What’s the best way to invest for our children’s future? The anxiety kept me up at night.

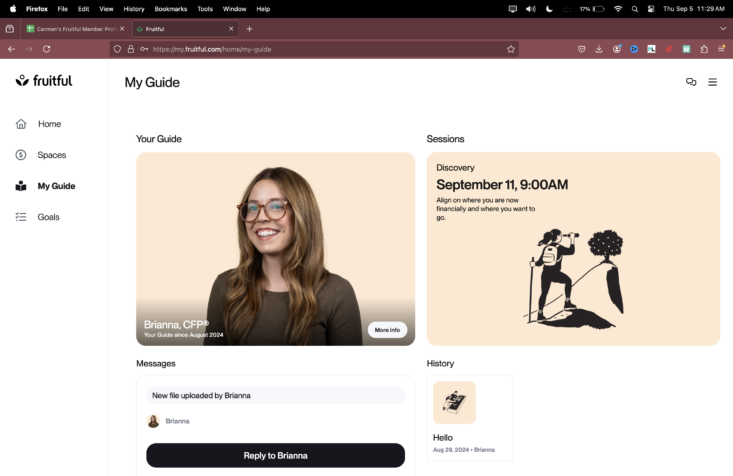

But then we selected Brianna as our Fruitful advisor, and she helped us set realistic, achievable goals. Brianna guided us in organizing our finances around key priorities like education, home investments, and insurance, while also helping us navigate the best financial strategies—all covered by one straightforward membership fee. Now, planning for another kiddo (or two) feels far less daunting.

Flexible and Convenient Financial Advice

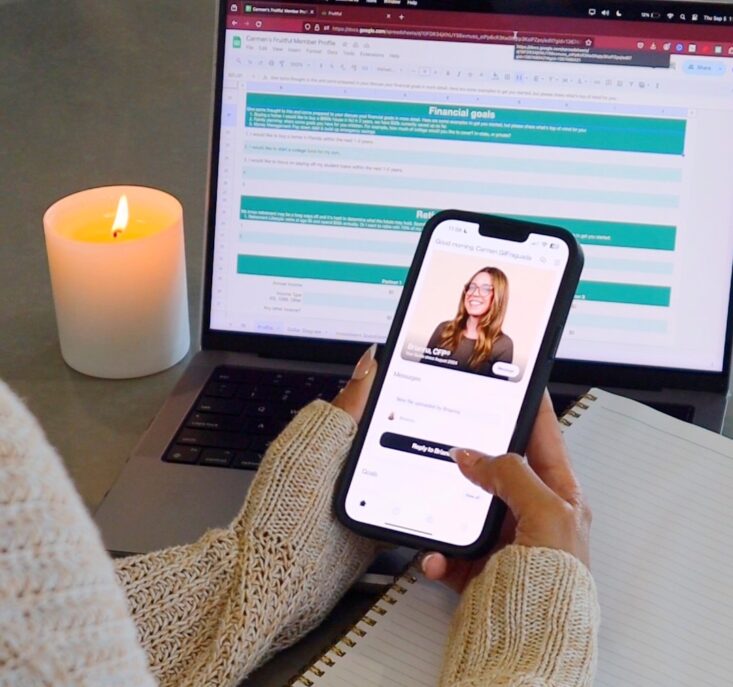

As a busy mom and solopreneur, finding time for anything can be a challenge. Some days, I barely have time to grab lunch, let alone sit down for a financial planning session. But with Fruitful’s flexible approach, I can connect with my advisor at times that work for me—through video chats, messages, and phone calls. Whether it’s during a daycare run or over my morning coffee, I know I have access to Brianna’s support, and it’s never more than a quick chat away.

Empowering Education Alongside Expert Advice

Fruitful doesn’t just offer financial advice; they partner with you in your financial journey. Brianna guides me step by step, ensuring I understand each part of our plan. Instead of simply providing recommendations, she explains the ‘why’ and ‘how’ behind them. This approach has helped me move from feeling overwhelmed to confidently discussing investment strategies and retirement plans, all tailored to my family’s unique needs.

With Brianna’s personalized guidance, I’m no longer just following instructions—I’m fully engaged in my financial future, feeling empowered and in control.

Holistic Planning

What sets Fruitful apart is their comprehensive approach to financial planning. It’s not just about saving; it’s about creating a balanced plan that covers all the bases—debt management, investing, budgeting, and more. This holistic view ensures that within the first 30 days, we had a clear picture of our finances and a roadmap for the future, no matter what life throws our way.

One of the biggest revelations for me was how quickly Fruitful’s personalized guidance helped us feel confident about our financial path. In just a month, we went from feeling uncertain to having a plan tailored to our family’s specific needs, putting us firmly on track toward our goals.

An Apt Name

Joining Fruitful has been one of the best—and most fruitful—decisions I’ve made for my family’s financial future. Their blend of personalized advice, educational content, and practical tools has not only helped me tackle my financial challenges but has genuinely transformed our lives. And with pricing on monthly plans starting as low as $98, it’s probably accessible to anyone ready to take control of their financial future.

If you’re looking to feel confident in your financial planning, empower yourself with Fruitful’s financial knowledge, and help support your family’s future well-being . I can’t recommend Fruitful enough. One of the most valuable steps I took was selecting the guide who truly understood our goals and needs. Why not start by choosing the Fruitful guide you’d like to work with?

Here’s to making our financial dreams come true—one smart, guided step at a time!

© Fruitful 2024 — All rights reserved. “Fruitful” refers to Fruitful, Inc. and its wholly-owned, affiliated, and separately managed subsidiaries, Fruitful Financial, LLC and Fruitful Advisory, LLC, an SEC-registered investment adviser. To learn more about Fruitful Advisory, LLC please view its Form ADV Part 2 and Form CRS available at www.adviserinfo.sec.gov. Registration with the SEC does not imply any level of skill or training. All investing involves risk, including the risk of losing the money you invest. Only members of Fruitful, Inc. have access to products and services across the Fruitful affiliates and subsidiaries.